Specialist Solutions & high-net-worth

Specialist Solutions

Protection solutions designed for the specialist needs of your clients.

Your clients are looking for the best. And as protection specialists, we can provide the products and service to meet their expectations.

Together, we'll work on large, complex and exceptional cases to provide bespoke cover – all designed to match the needs of your clients. Our in-house premier service team is made up of senior financial underwriters and dedicated customer care experts.

Read on for the details of our specialist solutions or get in touch with the team on 0330 303 0110 or gm-specialistsales@aiglife.co.uk.

More about our Specialist Solutions

Whole of life insurance

A tax-free lump sum upon death or diagnosis of a terminal illness. Our guide looks into the different ways whole of life can be used to help your clients.

Inheritance Tax planning

Cover inheritance tax liabilities for both the long and short term. Our whole of life and level term products are available on a joint-life, second death basis.

Investment IHT liability cover

A tailored solution to cover the two year inheritance tax (IHT) liability on investments into business relief qualifying investments, such as Enterprise Investment Schemes.

Instant portfolio protection

Cover for a client's investment portfolio should the breadwinner die before retirement. The application takes just eight minutes on average and there's no further medical or financial evidence required.

Business protection

Financial protection for a company in the event that its owners or key employees are affected by illness or death.

Relevant life insurance

A death-in-service benefit for employees, which pays out a lump sum on death or diagnosis of a terminal illness. Employers can cover up to 35 times of an employee's salary (depending on age).

High net worth

It’s important to get it right first time for your high net worth (HNW) clients. That’s why our products are combined with excellent service and the high levels of cover you’re looking for.

We can offer cover up to £100m level term, £52m whole of life, £3m critical illness, £10m (commuted value) family income benefit and £250,000 per annum income protection.

More about high net worth cases

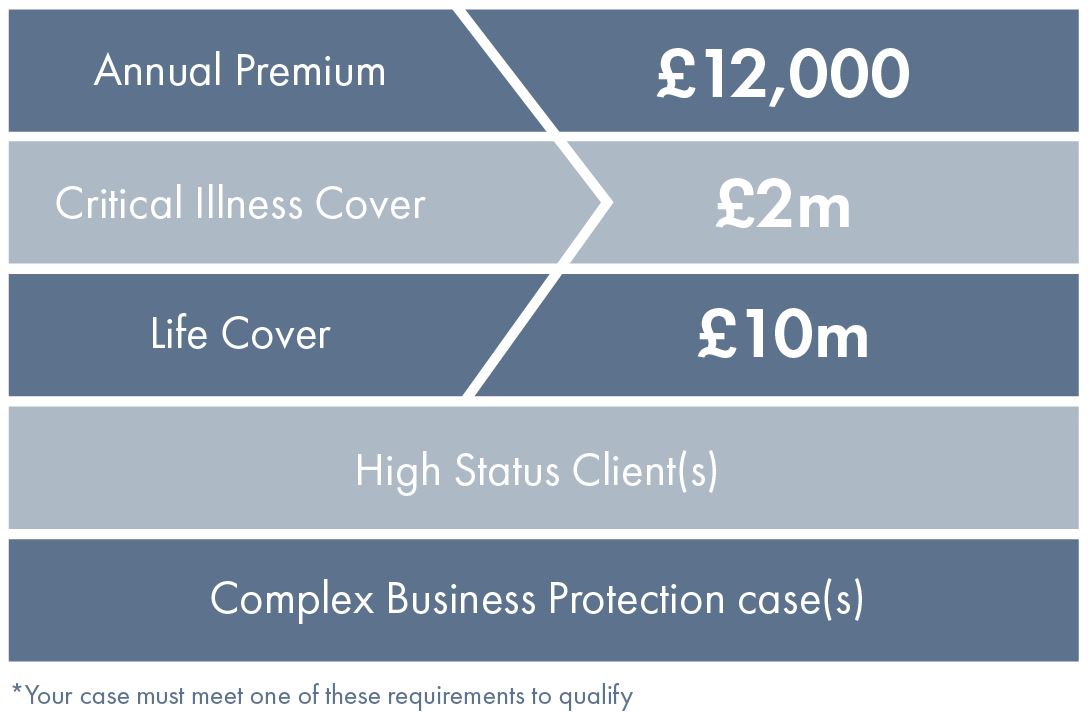

Premier service

All cases* will be looked after by our in-house premier service team, made up of senior financial underwriters and dedicated customer care experts points of contact for your case. They'll keep in touch with you throughout the application process, providing regular updates and all the support you need.

Financial underwriting

Here's the details of our financial underwriting for your HNW clients:

- No financial questions below £1.25m life insurance or £650,000 critical illness

- Financial evidence required for cases over £3.5m life insurance or £1.5m critical illness

- No paper financial questionnaires or GP reports – whatever the sum assured or age of the client

Immediate cover

Your client will receive immediate cover – temporary insurance while the application is being assessed. It's valid for up to 90 days from the date of a fully completed application, subject to certain exclusions.

They can receive up to a maximum of the sum assured or:

If you’d like to know more about our HNW service, or have a case you'd like to discuss, call our sales team on 0330 303 0110 or

email gm-specialistsales@aiglife.co.uk.

Tools and calculators

Whole of life calculator

This calculator can be used to compare the 'return' on a whole of life policy with a compounded investment at an assumed age of death of the client.

Relevant life calculator

You can use this tool to calculate the maximum amount of relevant life cover a customer can have. It compares the cost of relevant life to personal cover.

Premium equalisation calculator

Premium equalisation can help maintain the commerciality of an ownership succession arrangement using a business trust, by sharing the cost of premiums between the shareholders/partners/members.

Gift inter vivos calculator

Calculate the level term arrangement required to mirror the reducing IHT liability on a gift and compare the overall cost with AIG against a competitor.